Cryptocurrency has revolutionized the financial landscape, and at the forefront of this digital revolution is Bitcoin. Introduced by the pseudonymous Satoshi Nakamoto in a 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” Bitcoin has grown to become a significant player in the world of finance.

To deepen their understanding of such financial innovations, enthusiasts and learners alike can turn here at ImmediateFlow for valuable insights into investment education. In this article, we will delve deep into the various aspects of Bitcoin, including its history, technological underpinnings, impact on the financial world, challenges, and its future outlook.

The Birth of Bitcoin

Bitcoin as we know it was launched in the year 2009 by the Pseudonymous Creator, a person or group using the pseudonym Satoshi Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008.

Satoshi Nakamoto: The Mysterious Creator

Bitcoin’s creation remains shrouded in mystery, with the true identity of Satoshi Nakamoto still unknown. Nakamoto’s brilliant vision for a decentralized digital currency laid the foundation for the cryptocurrency revolution.

The Whitepaper that Started it All

In October 2008, Nakamoto released the Bitcoin whitepaper, outlining the concept of a peer-to-peer electronic cash system. This document provided the blueprint for the Bitcoin network’s architecture, introducing the concept of blockchain technology.

Early Adoption and Growth

Bitcoin’s initial days were marked by a small but enthusiastic community of early adopters who saw its potential. The first recorded Bitcoin transaction occurred in May 2010 when a programmer paid 10,000 bitcoins for two pizzas, highlighting its real-world use case.

Bitcoin as Digital Gold

Comparison with Traditional Assets

Bitcoin is often likened to gold due to its scarcity and store of value characteristics. Unlike traditional assets such as stocks or bonds, Bitcoin operates independently of governments and central banks.

Store of Value

Bitcoin’s limited supply of 21 million coins makes it an attractive store of value. Investors turn to Bitcoin as a hedge against inflation and economic uncertainty, similar to how gold has been used for centuries.

Hedging against Inflation

The decentralized nature of Bitcoin shields it from the effects of inflation, making it an appealing option for those seeking protection against fiat currency devaluation.

The Technology Behind Bitcoin

Blockchain Technology

At the core of Bitcoin lies blockchain technology—a distributed ledger that records all transactions across a network of nodes. This innovation ensures transparency, security, and immutability.

Mining and Proof-of-Work

Bitcoin miners use computational power to validate and add transactions to the blockchain. The proof-of-work consensus mechanism, while energy-intensive, ensures network security.

Scalability Challenges

Bitcoin’s growing popularity has exposed scalability issues, resulting in slow transaction speeds and high fees. Solutions like the Lightning Network and Taproot aim to address these challenges.

Bitcoin’s Impact on the Financial World

Disrupting Traditional Banking

Bitcoin’s peer-to-peer nature allows for direct transactions without intermediaries, challenging the traditional banking system and enabling financial inclusion.

Institutional Adoption

Institutional investors, including major corporations and hedge funds, have recognized Bitcoin’s potential and made significant investments, further legitimizing the cryptocurrency.

Regulatory Challenges

Governments and regulatory bodies grapple with how to oversee the rapidly evolving cryptocurrency space. Balancing innovation with consumer protection remains an ongoing challenge.

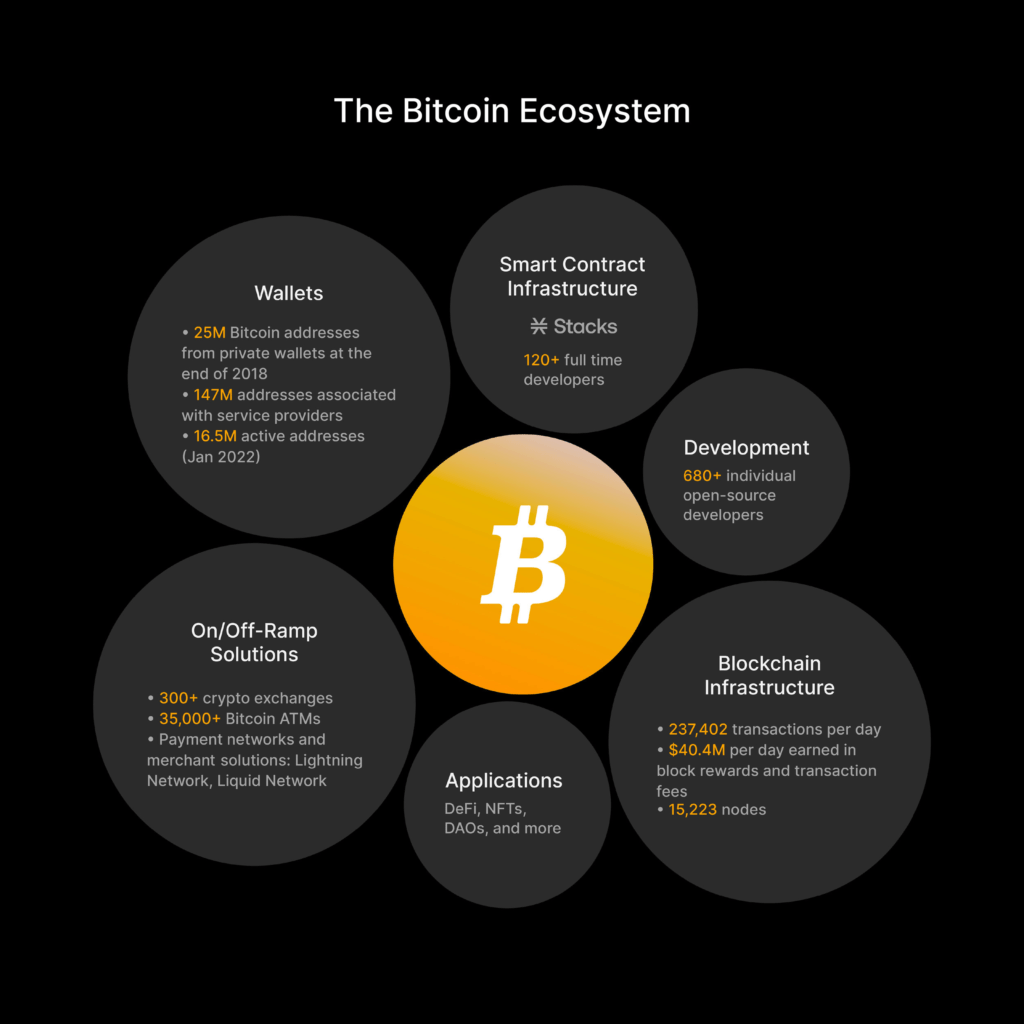

The Bitcoin Ecosystem

Bitcoin Wallets and Security

Various types of Bitcoin wallets, from hardware to software, offer different levels of security. Users must understand and implement best practices to safeguard their assets.

Bitcoin Exchanges

Exchanges provide a platform for buying, selling, and trading Bitcoin. These platforms play a crucial role in the liquidity and accessibility of the cryptocurrency.

Innovations in the Bitcoin Space

The Bitcoin ecosystem continues to evolve, with innovations like the Lightning Network enabling faster and cheaper transactions. Taproot, a recent upgrade, enhances privacy and functionality.

Challenges and Future Outlook

Environmental Concerns

Bitcoin’s energy consumption has raised concerns about its environmental impact. Sustainable mining practices and the transition to more energy-efficient consensus mechanisms are being explored.

Competition

Bitcoin faces competition from thousands of other cryptocurrencies, each with unique features and use cases. Adapting to maintain its leading position is essential.

Future Developments

The future of Bitcoin remains uncertain, with potential developments such as smart contracts and layer 2 solutions poised to expand its capabilities and use cases.

Conclusion

As Bitcoin continues to lead the charge in the world of cryptocurrency, its journey from a whitepaper to a global phenomenon has been nothing short of remarkable. It serves as a testament to the power of decentralized technology and the human desire for financial sovereignty. While challenges and uncertainties persist, Bitcoin’s influence on the digital economy remains undeniable, and its future potential remains an intriguing subject of exploration and discussion.