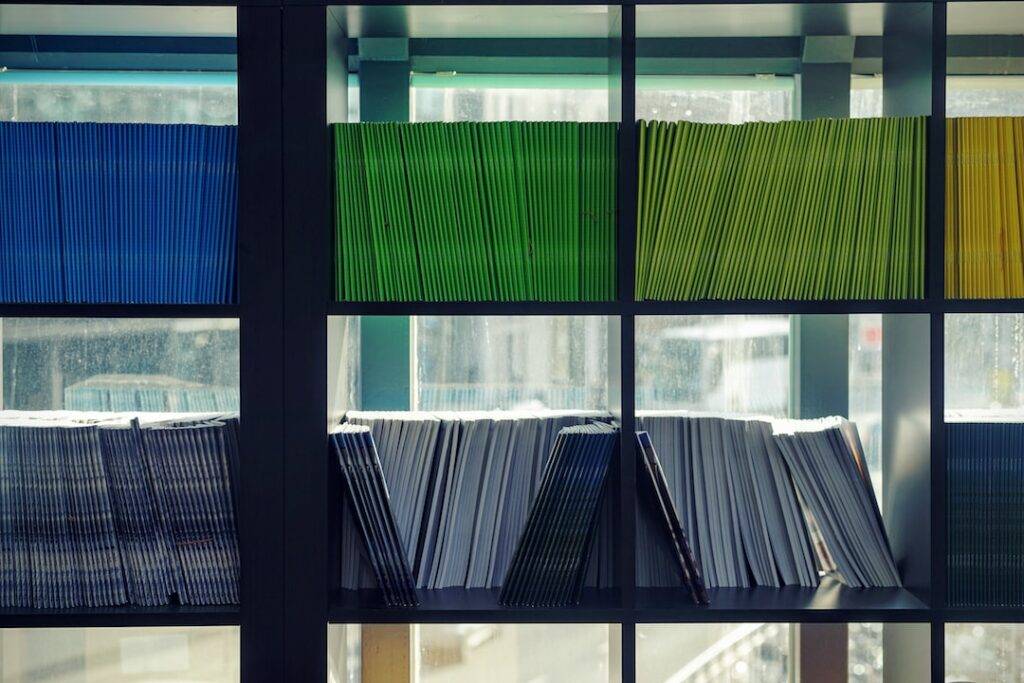

Proper tax planning and organization is essential when it comes to addressing complex financial matters. An organized tax filing system can save you from the hassles of dealing with countless tax documents and ultimately help you save time and money. In this article, you’ll learn about the importance of folders and how they can be an indispensable tool in your financial management toolkit. Keep reading to discover the essential components of tax organization and to find the best folder solutions for your needs.

Importance of Tax Folders for Efficient Financial Management

Tax folders play a critical role in streamlining your financial management process. They help you keep track of the various tax forms, bills, receipts, and other essential documents in a systematic and organized manner. By using folders, you can avoid misplacing essential papers and ensure that you have quick access to the information you need when it’s time to file your taxes or conduct a financial audit.

Organizing your tax documents in a folder allows you to have a clearer understanding of your financial situation and long-term tax planning. You’ll be able to identify deductions that you might have missed in previous years, which could lead to potential tax savings. Furthermore, having organized documents at your fingertips minimizes the risk of errors that could trigger an IRS audit or lead to hefty fines and penalties.

By investing in high-quality folders like Mines Press tax folders, you’re not only getting an essential organizing tool but also sending a clear message to your clients that professionalism is a top priority. Folders with customized layouts and designs can help build your brand image, so clients feel confident that they’re working with a reliable and trustworthy partner when it comes to managing their taxes.

Choosing the Right Type of Folder for Your Needs

The tax filing process can often be overwhelming and stressful, especially if you’re managing multiple clients or dealing with different tax scenarios. To make your tasks more manageable and maintain optimal organization, it’s crucial to get folders designed specifically to cater to your unique needs. Depending on the type of tax forms you work with, you can find specific folders that feature pockets, dividers, and slots that make document storage and retrieval a breeze.

In order to select the best folder for your needs, consider evaluating factors such as durability, degree of organization, ease of use, and professional appearance. By choosing a high-quality folder, you’re not only ensuring that your important documents are well-protected but also contributing to enhancing your professional image.

Once you find the ideal folder solution for your practice, consider using customized labels, stickers, or printing to make your folders stand out. This will not only make it easier for you to differentiate between various clients and filing types but also showcase your commitment to a high level of professionalism and organization.

Effective Record-Keeping and Tax Organization Strategies

Proper record-keeping and tax organization strategies are essential in ensuring a smooth tax filing process. When organizing your tax documents, make sure to categorize them based on their relevance and time frame. For instance, you can organize your records according to tax years, types of income, or specific tax deductions. This will help you avoid confusion and make it much easier for you to access specific documents whenever you need them.

Another essential aspect of tax organization is maintaining a digital backup of your records. Just in case you happen to lose your physical copies, you’ll still have access to your financial documents. Additionally, digital backups can simplify your tax preparation process, enabling you to easily share important files with your accountant or other relevant parties.

Lastly, make sure that your folders and documents are stored in a secure location. This is particularly crucial when dealing with sensitive financial information that could be compromised if accessed by unauthorized individuals. Consider investing in a secure storage system such as a locking file cabinet to enhance the safety of your tax documents.

Maximizing the Benefits of Folders

To fully maximize the benefits of folders, it’s essential first to commit to diligent record-keeping and organization throughout the year. By staying up-to-date with your tax records and consistently placing documents in their designated folders, you’ll save yourself from the last-minute rush and potential mistakes when tax season arrives. Furthermore, this proactive approach helps prevent missed deductions or overlooked tax breaks, ultimately leading to cost savings over time.

Another way to maximize the advantages of folders is to collaborate with other financial professionals or your accountant to ensure flawless tax organization and preparation. They can assist you in developing a strategic plan, providing valuable insight into potential tax savings, and ensuring that all tax forms, documents, and necessary data are accounted for.

Altogether, folders are an essential component of effective tax planning and organization. By using high-quality folders such as tax folders, implementing strategic record-keeping practices, and staying abreast of tax laws and regulations, you can simplify your tax filing process, reduce the risk of errors, and potentially unlock significant tax savings. Overall, folders are an indispensable tool that can help ensure a seamless and successful tax planning experience.